In this post, we will talk about SAP Central Finance (CFIN). This can be a supplementary “simplified” learning material that should help give you a high-level overview of Central Finance in SAP S/4HANA (SAP S/4HANA 2020) .

IMPORTANT: It is good to note that the content below refers to Central Finance in SAP S/4HANA (SAP S/4HANA 2020). I am mentioning this because there are different versions of Central Finance and the version you may be dealing with could be different. Some features do not exist in earlier versions so please keep that in mind.

Another thing to consider is that you should refer to other materials (for example: SAP Learning Hub content) if you would like to be certified in CFIN. This post will not be a deep dive of Central Finance and it is not a standalone material for certification review.

Overview

- What is SAP Central Finance?

- Notable Features

- Deployment Options

- Central Finance Landscape Architecture

- What is Replicated to SAP Central Finance?

- High Level Configuration

- Architecture Overview on Connection and Error Monitoring Summary

- Additional Information on Central Finance for Non-SAP Systems

- Helpful Links / Reference

1. What is SAP Central Finance?

SAP Central Finance is a finance deployment option for those who want to consume SAP S/4HANA features / innovations faster without changing the current setup of legacy systems.

I like to think of Central Finance as a “master finance system” that has the SAP S/4HANA features. It is a “Finance First” solution so the features will be focused on Finance processes.

In terms of data flow, the needed data from legacy systems will be replicated to the Central Finance system for processing.

2. Notable Features

There are a lot of notable features for Central Finance. Some of which are listed below.

Earlier it was mentioned that Central Finance is a way to consume SAP S/4HANA features faster and it acts as a “master finance system”.

By keeping that in mind, you will notice that there are features below that talk about “centralization” and having a “one source of truth” amidst the several SAP and non-SAP systems involved.

A. Real Time Replication

B. Centralization of Finance Operations

C. Central Reporting

- For customers that have both SAP and non-SAP systems, one good feature is to implement Central Reporting. This should give them a unified view of their financials across all systems (SAP and non-SAP) in the Central Finance system.

- The source systems are still the “system of records” while Central Finance system with Central Reporting will be a “reporting” system.

- Remember that the source systems are still up and running.

D. Central Payments and Central Down Payments

- In the context of an ERP source system, one feature I would like to highlight is the behavior of central payments wherein the Invoices in the source system will be marked as “technically cleared” when they are replicated to the Central Finance system.

- This means that you do not need to have those invoices cleared in the source system.

- The clearing and payment can be done in the CFIN system and it closes off the concern of “double work”.

E. Accelerate Intercompany Reconciliation

- Inter-Company Reconciliation (ICR) can run directly on Central Finance

- Process 1: Reconciliation of GL account open items

- Process 2: Reconciliation of vendor / customer open items (real time)

- Process 3: Reconciliation of GL accounts (documents)

F. Document Splitting is covered

3. Central Finance Landscape Architecture

There are 3 main “systems” that make up the Central Finance Landscape Architecture: Source Systems (highlighted in blue), SAP Landscape Transformation Server (highlighted in yellow), and the Target System which is SAP S/4HANA (highlighted in green).

Below are some key phrases or bullet points that will help you distinguish each. You will also understand the purpose of each system.

| Source Systems (SAP or Non-SAP Systems) | Highlighted in blue | Main business processes run here, and FICO docs are posted |

| SAP Landscape Transformation Server (SLT) | Highlighted in yellow | Reads and replicates |

| Target System (SAP S/4HANA Central Finance) | Highlighted in green | FICO docs are reposted here |

| SAP Master Data Governance (SAP MDG) | Within the target system, highlighted in pink | Mapping is done here and centralization of master data processes |

| Application Interface Framework (AIF) | Within the target system, highlighted in orange | Error handling tool |

Some notes on System Landscape Transformation (SLT)

Below are some screenshots of SLT. You can see the status of replication for each object type / name involved. By navigating to the “Expert Functions tab”, you should see various settings that can be configured.

Some notes on Master Data Governance (MDG)

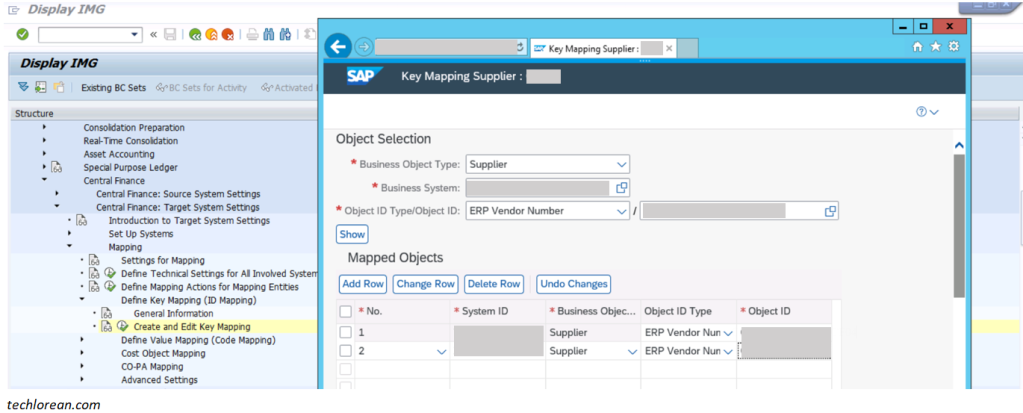

The screenshot below shows an image of key mapping maintenance where you specify the ERP vendor number in the source system and what it should be in central finance. You can think of it as a way to let CFIN understand what objects should “match” with each other.

Some notes on Application Interface Framework (AIF)

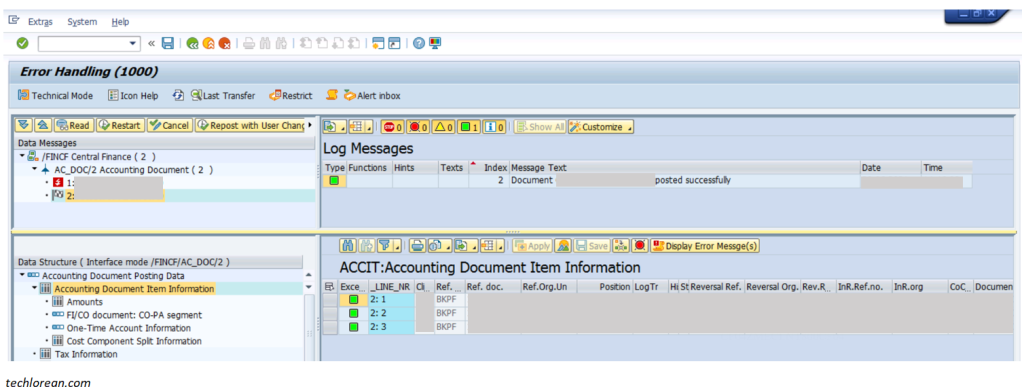

You can simply think of AIF as an error handling tool in SAP. You can go to the AIF to view if there are errors encountered during initial load and real time replication depending on the scenario.

For Example: if an error has been encountered for the real time replication of an FI document, it will show up in the AIF tool. If corrections are done, the record in error can be restarted / reprocessed so that it pushes through.

4. Deployment Options

Earlier, we talked about the 3 main “systems” that make up the CFIN architecture. Recall those 3 systems as we go through their deployment options.

Listed below are deployment options available for Central Finance and other related components. We will not talk about the versioning and in-depth technicalities of each component. Instead, the below serves as a high-level overview of the options available.

Central Finance

- Upgrade & Migrate – Upgrade ALL

- Upgrade, Migrate, & Consolidate (Merge or reduce # of instances)

- Replicate to Central Finance (leave as is and optionally reduce # of instances over time)

SAP Master Data Governance (SAP MDG) – Optional

- As a separate standalone master data hub

- On top of SAP S/4HANA system

SAP Landscape Transformation Server

- As an add-on on any SAP source system

- On a separate host (recommended)

- Used as a central component which serves multiple source and multiple target systems

Additional Information

It is good to note that Central Finance is designed for “quick deployment”. It also caters to an iterative or accelerated roll out where there are several deployment “waves”. The customers have the option to choose what (and when) they want to roll out.

Moreover, keep in mind that there is no “fixed” order when it comes to choosing what is rolled out first between non-SAP and SAP systems. The customers can decide which comes first depending on their prioritization.

5. What is Replicated to SAP Central Finance?

In Central Finance, there is such a thing as “real time replication”. Below are the list of objects and data that can be replicated to CFIN if needed.

Again, keep in mind that we are talking about Central Finance in SAP S/4HANA 2020.

- FICO Postings

- EC-PCA Internal

- Cost Objects

- Commitments

- Logistics Information (AVL)

- Activity Rates

- Material Cost Estimate

- Internal Orders

- Projects / WBS

6. High Level Configuration

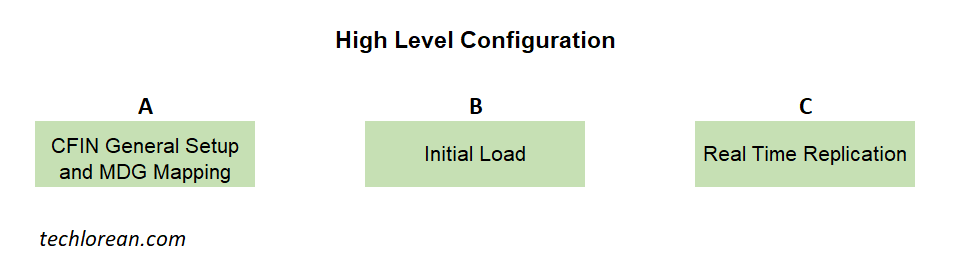

To better understand the high level CFIN configuration, allow me to group some tasks and arrange them so that we have a linear flow.

Of course, doing a deep dive of the configurations required for each will have more information and will involve technical aspects. What we have below is a “simplified” version so that there is an overview of what needs to be done.

Note: Consider that in the scenario below, MDG is installed on top of the SAP S/4HANA system. SLT is an add-on on the SAP S/4HANA system as well.

For now, the configurations are grouped into 3 parts:

- Central Finance General Setup & MDG Mapping

- Initial Load

- Real Time Replication

A. Central Finance General Setup & MDG Mapping

Activities and tasks related to the Target System (Central Finance), MDG Mapping (on an MDG standalone hub or on top of S/4HANA system), and Source System (for example SAP ECC activities will include the installation of several SAP Notes as one of the prerequisites) need to be done.

The main idea is to get these systems ready for the next group of activities related to initial load.

Some examples of CFIN general setup & MDG mapping activities and tasks involve:

- Business Function Activation in Central Finance target system

- AIF runtime configuration

- RFC and Logical System configurations

- Configuring decimal places for currencies

- Checking mapping settings (key mapping and value mapping) – I can discuss the difference of the 2 mappings in another post.

- Utilization of MDG Mapping Tool for MASS upload, download, and deletion of mapping values (SE38 FINS_CFIN_MAPPING or /NFINS_CFIN_MAP_MANAGE)

- Checking cost object framework mapping

- Performing smoke test for cost object framework mapping

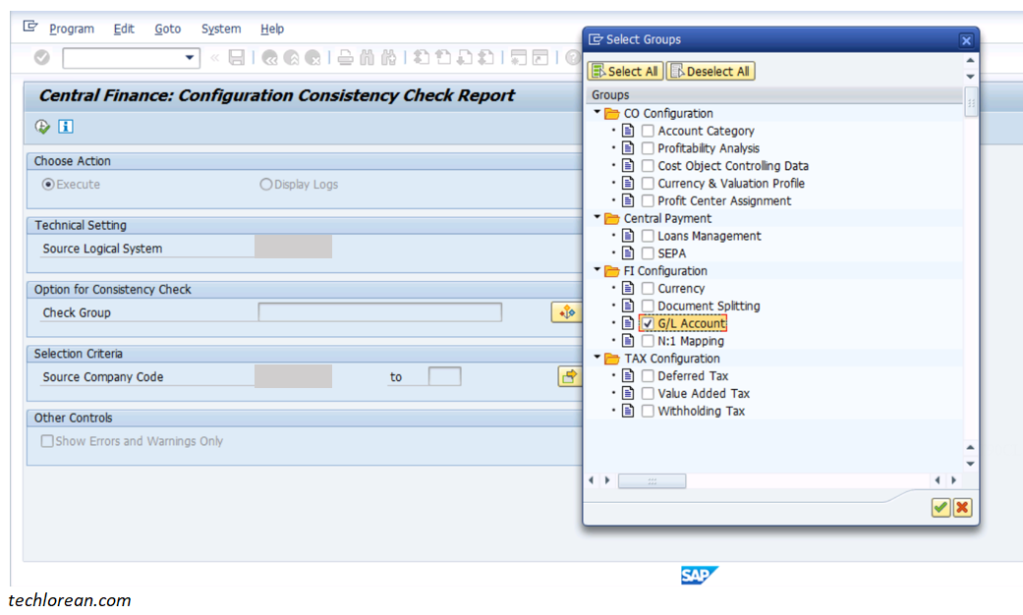

- Configuration Consistency Check via /NFINS_CFIN_CC

Some examples of source system activities and tasks involve:

- Applying SAP notes to enable SAP source systems for CFIN integration

- Assigning of authorization to SLT user

- Source system configurations for Central Finance

- Preparation of Source System for Initial load (for example: perform closing for periodic asset, execute periodic depreciation run, etc.)

B. Initial Load

Activities and tasks related to initial load need to be done. Ideally, you want certain postings, cost objects, data, and/or other needed information to be in the Central Finance system.

Initial load needs to be carried out so that the real time replication runs smoothly – considering that object dependencies are done in the initial load.

I also like to think of the initial load as a “massive data load” wherein needed data prior to central finance go live will be moved to the target system.

The high-level order of initial load execution will be:

- Loading cost objects

- Initial load of FICO postings

- Initial load of CO internal postings

The above order is in place because you want to consider prerequisites or data dependencies.

For example: if you want to perform an initial load for FICO postings under company code 1000, those postings will most likely have cost objects. To prevent errors in initial load such as “Internal Order 123456 does not exist for company code 1000” or “Cost Center C12345678 does not exist”, it is good to have those cost objects loaded first.

Some examples of initial load activities and tasks involve:

- Initial load of AUFK

- Initial load of FICO postings

- Comparison of actual and expected CO posting

- Perform smoke test of CO document replication

- Initial load of CO postings

- Initial load of COBK

- Troubleshooting of initial load errors (example via SPRO transaction and /N/AIF/ERR)

- Comparison of FI document headers via SE38 FINS_CFIN_DFV_FI_DOC_COUNT

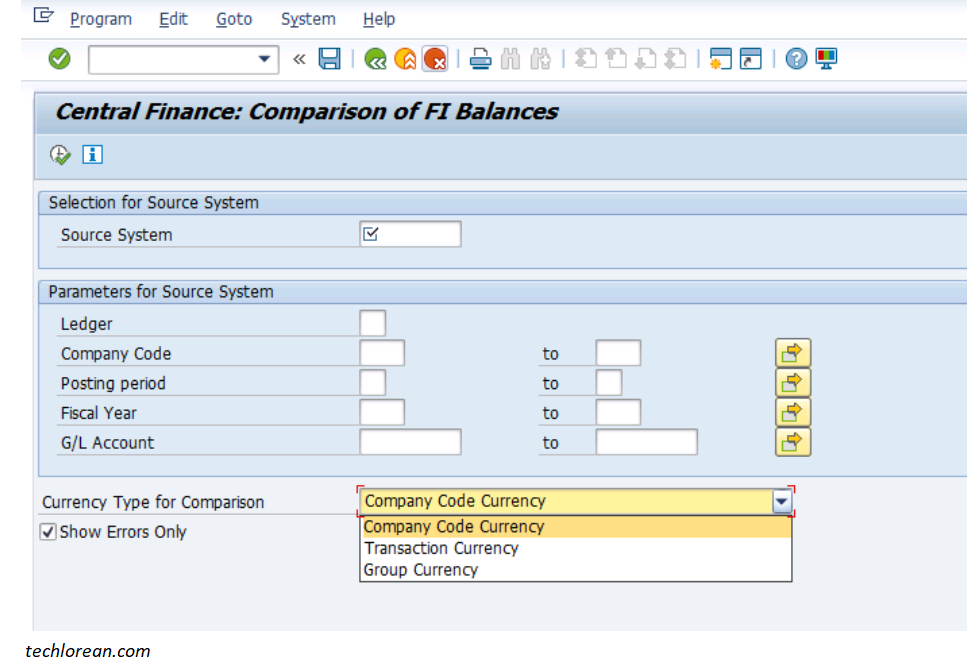

- Comparison of FI balances via SE38 FINS_CFIN_DFV_FI_BAL_COMPARE

- Comparison of FI line items via SE38 FINS_CFIN_DFV_FI_DOC_COMPARE

- CO Documents count via SE38 FINS_CFIN_DFV_CO_DOC_COUNT

- CO Documents comparison via SE38 FINS_CFIN_DFV_CO_DOC_COMPARE

C. Real Time Replication

Real time replication tasks and activities will be the next step when initial load has been performed and tested successfully. This is where we trigger the “real time” functionality of Central Finance.

For example: when a vendor invoice is posted in the source system, that invoice will be replicated in the central finance system. The business is then able to view that invoice and its related reporting in the central finance system.

Some examples of initial load activities and tasks involve:

- Checking the Initial Load Finished Indicator in the source system via SM30 VCFIN_SOURCE_SET

- Setup of COPA and Replication of Source COPA Document. Ensure to compare the COPA configuration in both source and target systems.

- Validate COPA characteristics mapping in target system

- Triggering and Checking AUFK, COBK, CFIN_ACCHD, etc. replications in the target system via LTRC

- Monitoring and troubleshooting errors in the target system via /N/AIF/IFMON

- Setup of Central Payments functionality (also involves VAT tax consistency check and checking of configuration of source system if this functionality will be enabled)

7. Architecture Overview on Connection and Error Monitoring Summary

In terms of visualizing the connectivity and error monitoring, the below table should help give you an overview of what is involved per action / stage.

If you are not familiar with RFC, you may refer to my post on: SAP Interfaces in a Nutshell

8. Additional Information on Central Finance for Non-SAP Systems

Some might have concerns on the involvement of non-SAP systems in the Central Finance perspective. For example, if the source system is not an “ERP” system, the data could be structured in a way that SAP will not readily understand. It is doable but it may also increase the timeframe to complete the Central Finance deployment.

For those interested, there are pre-built solutions from Magnitude that will help ease those integration concerns. It caters to both SAP and non-SAP systems.

You can search more on “SAP Central Finance Solution Extensions from Magnitude”. I can discuss more on this in another post. For now, you can take note of some of the following Data Sources that are covered by the pre-built solutions.

Some of the Data Sources covered:

- SAP ECC & S/4HANA

- Oracle EBS, JD Edwards, PeopleSoft, Netsuite

- Microsoft Dynamics AX

- Workday

- Infor SyteLine

- Universal Flat File Format

9. Helpful Links / References

- SAP S/4HANA for Central Finance

- Connect SAP S/4HANA Central Finance with any third-party data source

- SAP Help: Central Finance

- SAP Cheat Sheet: Central Finance General Transaction Codes

I hope this helps. Good luck! 😊

That’s a great blog on SAP Central finance! We can indeed manage our finance at one-spot using this amazing platform. Do check out our blog on SAP Bank Communication Management: https://iquantm.com/sap-bank-communication-management/

LikeLike